owe state taxes california

If none of your income is from Social Security your California tax burden would be about 1100. California residents - Taxed on ALL.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

IR-2022-88 April 18 2022.

. For the latest tax year your California corporation had taxable net income of 100000. If about 36000 of your income is from Social Security you would owe no California tax. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Of all the states that levy a state income tax only a handful exclude unemployment benefits and California is one of them. Below are additional reasons why you may owe state income tax compared to last year. Cant Pay Unpaid Taxes.

5110 cents per gallon of regular. Taxes are not the same in each state they are calculated differently. You didnt defer or you deferred.

You can get up to 3027. Some taxpayers instantly qualify. California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the US.

WASHINGTON Taxpayers requesting an extension will have until Monday. Once you know your Allocation Ratio multiply your total RSU income from the 612020 vest date by your Allocation Ratio. Other things being equal your corporation will owe California corporate income tax in the.

If you qualify for the California Earned Income Tax Credit EITC 7. A 1 mental. Possibly Settle For Less.

Extensions of time to file tax returns. If you do not owe taxes or have to file you may be able to get a refund. How California taxes residents nonresidents and part-year residents.

The states Franchise Tax Board is the state income tax collector and it has a fearsome reputation. There are also states that apply no income tax but they still have ways to collect money. CA Taxable Income Total RSU income from vest x Allocation.

FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other. Your 2019 State Tax Withholding was lower than 2018. 073 average effective rate.

It comes in fourth for combined income and sales tax. Both personal and business taxes are paid to the state. Important State gas price and other relief proposals.

The state of California will require you to pay tax on the profit. California State Tax Quick Facts. Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More.

9 rows California state tax rates are 1 2 4 6 8 93 103 113 and 123. Federal income tax still applies. Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600.

If you had money. How much you owe. Most tax lawyers will tell you that they would much rather fight the IRS.

In California the lowest tax bracket is. Paying taxes owed to the state of California can be completed either online in person by mail or by telephone.

California S Tax System A Primer

Do You Live In The State Of California And Have Not Filed Your Income Tax Returns In A Few Years Has The Income Tax Return Business Tax Debt Payoff Printables

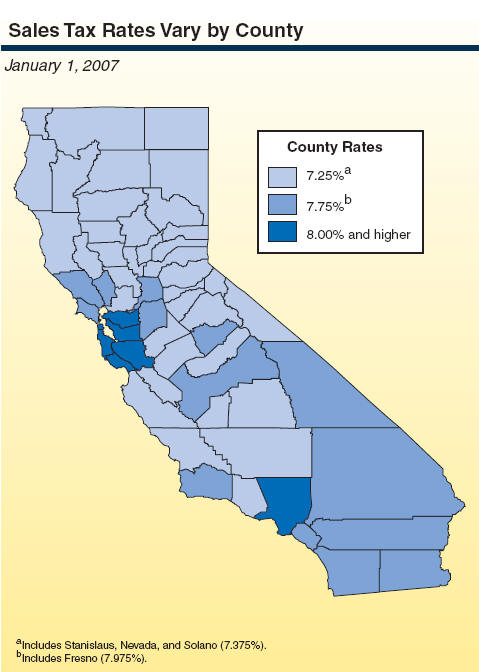

Understanding California S Sales Tax

California Eviction Process 2022 Laws Timeline Faqs In 2022 Being A Landlord California Process

Understanding California S Property Taxes

Jax Taylor S Salary From Vanderpump Rules Is Revealed As He Fails To Pay Off 1 2 Million Tax Debt Vanderpump Vanderpump Rules What Is A Father

Failure To Pay Owedtaxes Will Result In Penalties Interest And Liens Along With Frozen Bank Accounts And Seized Payroll Taxes Wage Garnishment Tax Services

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

I Owe California Ca State Taxes And Can T Pay What Do I Do

California Sales Tax Small Business Guide Truic

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Vorlagen

California Tax Rates H R Block

California Use Tax Information

California S Tax System A Primer

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

Pin By Jon Schlussler On Taxes In 2021 Irs Learning Publication

Reports Show That The Irs Has Mistakenly Paid Out Billions In The Past Decade To Identity Thieves And People Who Fraudulently Claim Tax Debt Irs Taxes Tax Help